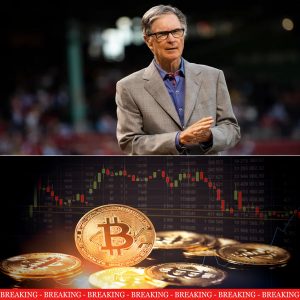

Red Sox Owners’ $300 Million Crypto Gamble: Fenway Sports Group’s Bold Investment Sparks Shockwaves and Fan Anxiety

BOSTON — The baseball world is no stranger to risk, but this one feels different.

According to a bombshell report from Bloomberg Sports, Fenway Sports Group (FSG) — the ownership group behind the Boston Red Sox, Liverpool FC, and Pittsburgh Penguins — has secretly poured $300 million into a new crypto-funded sports investment fund, raising eyebrows across both Wall Street and Major League Baseball.

The move, described by sources as “an aggressive push toward digital financial innovation,” has left fans divided and industry analysts stunned. For some, it’s a sign that FSG is embracing the future of global sports economics. For others, it’s a red flag — a high-stakes gamble that could put the Red Sox’s financial foundation at risk.

“This isn’t just a baseball decision,” said one veteran sports economist. “It’s a signal that FSG wants to position itself at the front line of a financial revolution. But revolutions can burn fast.”

A Quiet but Controversial Move

The reported investment comes at a volatile time for both cryptocurrency and professional sports ownership. Crypto markets, once hailed as the next frontier of wealth, have struggled with instability and regulatory scrutiny over the past two years.

Yet FSG, led by billionaire John Henry and chairman Tom Werner, reportedly views blockchain-backed sports financing as a “transformational opportunity.” The fund — whose name has not yet been disclosed — is said to focus on digital sports assets, global team equity, and athlete-driven NFT platforms.

“It’s about future-proofing,” one FSG insider told Bloomberg Sports. “We believe sports investment is evolving, and this is where the growth will be.”

Still, the secrecy surrounding the deal has raised concerns among Red Sox fans, who fear that Fenway’s ownership may be stretching itself too thin. After a frustrating season that saw Boston fall short of playoff contention again, many fans believe the focus should be on roster improvement — not blockchain experiments.

Fan Reaction: Excitement or Fear?

Reaction in Boston has been swift and emotional. Some supporters applauded the move as visionary, comparing it to FSG’s early adoption of data analytics and international partnerships that once revolutionized team operations.

But others were quick to voice skepticism. Social media lit up with criticism, one viral post reading: “Fenway’s investing in crypto while the bullpen collapses — make it make sense.”

On local sports radio, callers questioned whether the owners were prioritizing innovation over baseball. “We’re fans, not shareholders,” one caller said. “Spend $300 million on pitching, not on crypto dreams.”

A Crossroads Moment for Fenway Sports Group

This isn’t the first time FSG has pursued ambitious financial ventures. The group, which turned a $700 million Red Sox purchase into a multibillion-dollar sports empire, has long been known for calculated risk-taking. But this time, the stakes feel different — because crypto is not a ballgame anyone fully understands.

If the fund succeeds, it could open new frontiers in how teams are financed and how fans engage with their franchises through digital ownership and blockchain-based fan tokens. If it fails, however, it could expose one of baseball’s most iconic brands to unnecessary volatility.

“Fenway has always been about tradition,” said one MLB executive. “But now they’re betting on disruption. The question is — can both exist in the same ballpark?”

For now, FSG remains silent, offering no public comment on the report. But in Boston, a city that knows how to balance hope and heartbreak, one sentiment dominates: curiosity mixed with unease.

Baseball has always been a game of risk and reward — and the Red Sox ownership may have just taken that philosophy to a whole new level.

Leave a Reply